IRS Reduces Paper Filing Threshold for Information Returns

The Internal Revenue Service (IRS) has announced that it will lower thethreshold for filing information returns on paper from 250 to 10, starting fromthe 2023

The Internal Revenue Service (IRS) has announced that it will lower thethreshold for filing information returns on paper from 250 to 10, starting fromthe 2023

When it comes to working with contractors, obtaining a completed W-9 form is essential. The W-9 serves as an information return, providing necessary details to

Managing your business’s finances and ensuring accurate tax reporting is crucial for smooth operations. While a Certified Public Accountant (CPA) plays a significant role in

When it comes to managing your accounting tasks, QuickBooks and Wagefiling are two popular options to consider. While QuickBooks is a comprehensive accounting system that

The Taxpayer First Act of 2019, enacted on July 1, 2019, has paved the way for potential new regulations regarding the requirements for filing 1099

Late filing penalties can have a severe impact on small businesses. To safeguard your financial well-being, it’s crucial to file your returns on time. With

If you have hired a caregiver and paid them over $2,100 in a year, you may be subject to the Nanny Tax. The Nanny Tax

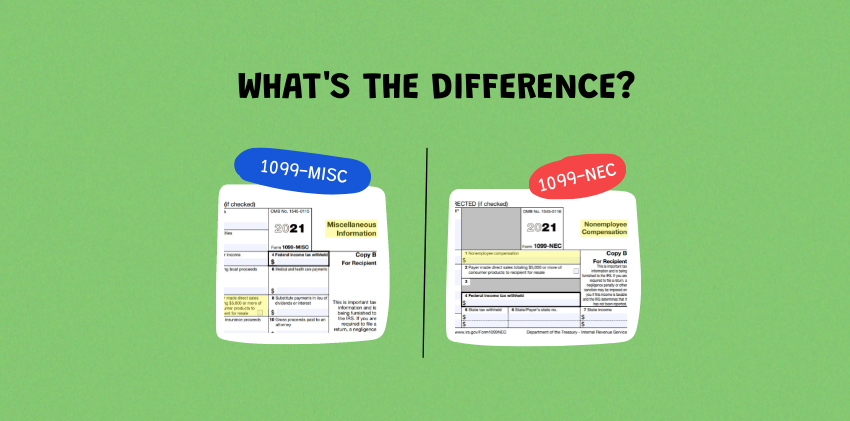

A 1099 NEC form is only for reporting Non-Employee Compensation. This used to be reported on 1099 MISC in Box 7 but the IRS split

Penalties for late filing can devastate a small business. Take a look at the chart below to get an idea about how much the penalties

In a perfect world, all of the information you need would be easy to find or readily available when you need it. In that same

WAGE FILING © 2024 | All Rights

Reserved